A spotlight by Collin Ng, Experienced Consultant.

Accounts receivable financing can play a key role for the success of your company by improving your liquidity and providing protection against buyers who are unable to pay their invoices.

Take for example a furniture entrepreneur who buys raw materials like wood from an overseas supplier, manufactures wooden furniture, and sells them to local and overseas markets. Furniture buyers are typically given a credit term of 30 days, 60 days or even 90 days, depending on the business relationship. In the meantime, these businesses will need cash flow to operate the day-to-day expenses, payroll, maintenance as well as to purchase more raw materials. Such businesses can turn to banks or financial providers to ease their cash flow difficulties, enabling them to focus on their core business activities. One such financial service is called Accounts Receivable Financing, whereby a bank purchases these invoices and offers a cash advance to these businesses.

What is Accounts Receivable Financing and how does it work?

There are many variations which can be tailored to different market demands. They have different product names, the most prevalent among them: Invoice Financing, Factoring, Accounts Receivables Finance and Accounts Receivables Purchase. Sometimes these names are used interchangeably.

Businesses can enter a relationship with a bank to purchase their accounts receivables, namely their invoices. Depending on the credit worthiness of the business, the bank will determine the cash advance ratio to provide to the business. For example, with an 80% ratio, the bank can disburse $800 to the business from a $1,000 invoice. When the invoice is due, the bank will collect the payment and offset the amount disbursed, and collect the calculated interest and associated fees.

Banks can provide a variety of services, such as payment channels for buyers, debt collection services for businesses, and periodic reminders and follow-ups.

Since the market is very diversified, there are different combinations of offerings that can be structured to meet different needs. These offerings can include domestic, import and export scenarios, or recourse or non-recourse arrangements. Depending on the needs of a business, this relationship can either be disclosed or remain undisclosed.

A bank benefits from the interest income from lending and the fee income from the services rendered. A business benefits from having excess liquidity to operate their business and banking services.

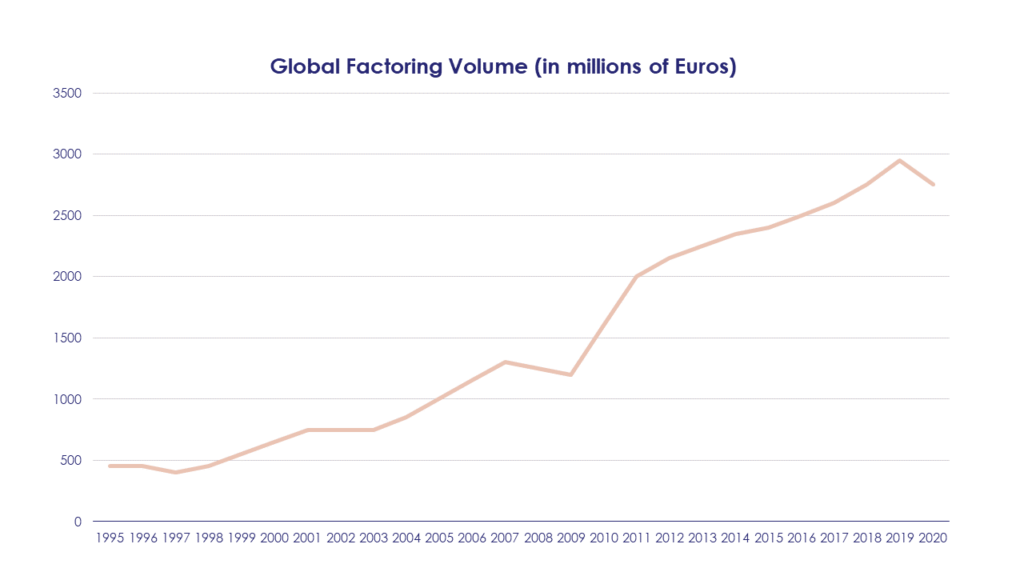

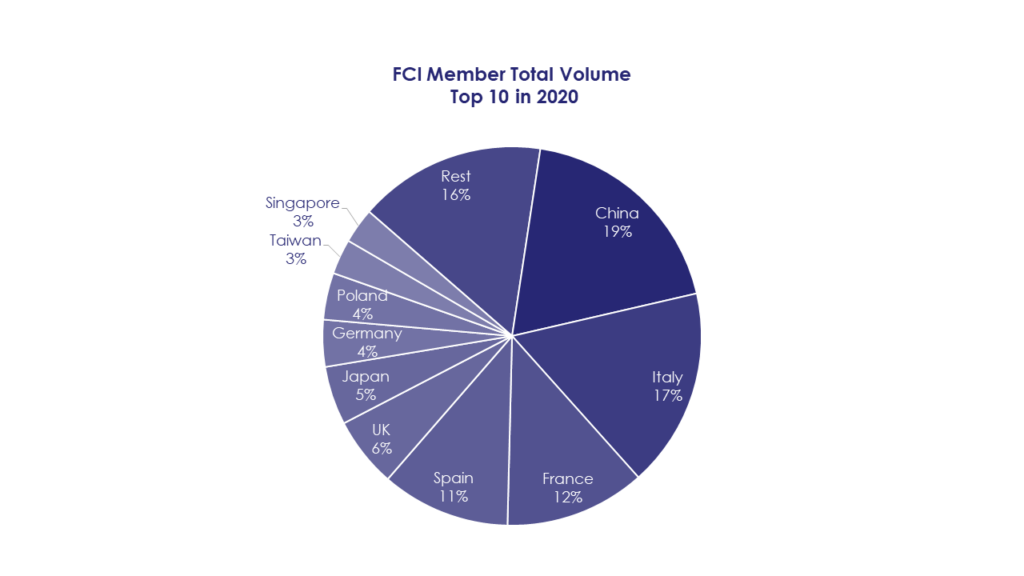

FCI is a de facto membership body for the banks and financial services which offer accounts receivables financing. The following charts illustrate the increasing volume and geographic composition of account receivables at a global scale (in millions of Euros) as reported by FCI:

Although there are subtle differences between factoring and accounts receivables financing, the term “factoring” is used almost identically.

What are the potential business opportunities?

Beyond having a computer system to manage the tracking of the invoices, the finances and accounting, and to support the interactions and transactions between the bank and clients, it is also possible to link up with the rest of the core banking systems. This can improve a business’ ability to deliver smooth running operations, meet regulatory requirements and derive synergies from their bank’s other offerings.

There is additional potential for expansion with the following processes and practices:

- Robotic Process Automation (RPA)

- Digital Solutions

- Liquidity Management and Cash Management

- Cross-selling opportunities

RPA

Businesses that are not digitally-ready will rely heavily on paper documentation for tasks like invoice processing, and these will necessitate manual labor. Many business operations which previously required manual labor can now be automated, such as invoice management, cash advances processing, and handling buyers’ receipts of payments. Using RPA for these manual tasks and processes can certainly help decrease operating costs as well as reduce costly operational errors.

Digital Solutions

There are opportunities to link up clients digitally so that they can access and make transactions with their bank online. Going even further, integrating business’ computer systems will improve client convenience, particularly in areas like volume processing, error reduction and potentially operating costs.

There is room to explore the user journeys and re-engineer the user interface and user experience (UI/UX) to bring more value to the table. There are also opportunities to integrate a business’ system with the rest of their bank’s operating landscape.

Liquidity and Cash Management

With accounts receivables, there are opportunities to provide value added services, such as liquidity and cash management services. Along with other accounting parameters like payables, these services will make it easy to plot information out regarding future cash flows, and to create alerts for potential shortfalls and possible actions to address them.

Cross-selling

In the event of a potential cash flow shortage, a short-term loan offering could be beneficial. Likewise, there are opportunities for banks to cross-sell financial products to make full use of a business’ excess liquidity.

Integrating with the rest of a bank’s systems can enable a company to fully exploit their business potential. Banks should encourage these businesses to access their foreign exchange platform, supply chain management and even their loyalty programs.

Even though Accounts Receivables Financing is a small piece in the lending landscape, it is still a vibrant business in many geographic regions. There are abundant opportunities for modernizing IT systems, re-engineering business processes, as well as internal and external integration. Moreover, in the modern era of digital information, there is a whole wealth of data and information that is waiting to be mined and put to good use.

Do you want to learn more? Discover our Financial Services industry knowledge.